AirDNA Uses Data To Help Investors and Owners on Maui

_(1).jpg)

For those that already own or are looking for an AirBnB/short-term rentable condo somewhere, you’re likely familiar with AirDNA. If you’re not, you should definitely check out the tools they have available. It’s an amazing suite of technology that can not only help you vet potential vacation rental opportunities by giving you specific, hyper-local data about comparable nightly rates, occupancy percentages, etc, but it can also help you manage and scale your operation if you are self-managing.

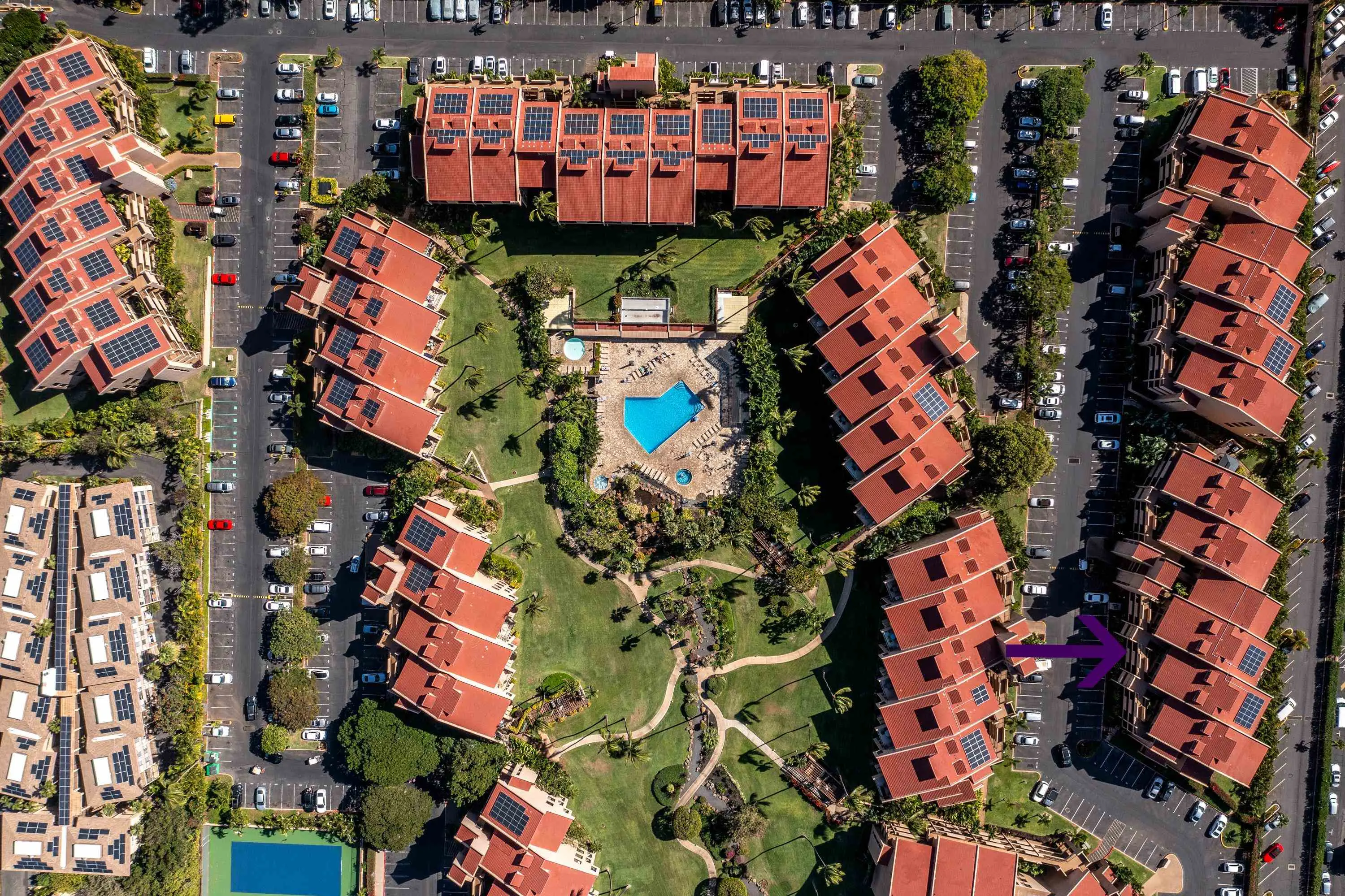

AirDNA regularly publishes articles about short-term vacation rentals and recently published an article ranking the top 10 markets to invest in a short-term rental condo. To the surprise of very few, Maui came in at the top of the list. However, Maui didn’t get awarded first place because we have beautiful beaches and an ideal tropical climate.

What Makes Maui The Best Short-Term Rental Market According to AirDNA?

_(2).jpg)

Maui came in first because of how the numbers look from an investment perspective. Extremely high occupancy rates, strong year-over-year revenue growth, and an average annual gross revenue that exceeds $100,000 per unit make Maui unbeatable. A very powerful combination for investors. Simply put, Maui has been, is, and will continue to be in high demand and in demand by those who don’t mind paying a premium on travel.

Despite the recent shift in the real estate market, short-term rentable condos are still going under contract very quickly, many with multiple offers. Prices are still going up on these properties and unless something major happens with a significant increase in supply or decrease in demand, prices are likely to continue to go up unabated.

Based on the data, the second best place to own a short-term rentable condo according to AirDNA is Kenai Peninsula, Alaska and number three was Chattanooga, TN.

Maui Is Significantly Ahead of National Averages

Taking a brief glance at the AirDNA website, we can see that all Maui short-term rental units average an impressive 90% occupancy and now average around $413 nightly. Maui is dramatically ahead of other markets around the country in this respect.

Based on the data collected by AirDna, they report that short-term rentals across the United States saw an occupancy rate of 62% in 2021. This was up 5% from 2020, and up 10% from 2019. Along with this increase in occupancy came an increase in average annual revenue which rose from an average of $40,000 per year nationwide in 2018 to nearly $60,000 per year in 2022.

Of course, we also have a higher barrier to entry on Maui with our average short-term rental value in the $800,000-850,000 range.

Why Maui Has an Advantage as an AirBnB on The Supply Side Indefinitely

In 2018, Maui County significantly changed the landscape of short-term rentals on the island by amending the requirements to legally rent a property on Maui on a short-term basis, which is defined as a period of fewer than 180 days. Click here to view the current short-term rental rules on Maui.

Transient accommodations are also now only legal in approved zoning districts, such as Hotel (H-1) and Apartment (A-1, A-2). To operate outside of these districts on a residentially or agriculturally zoned property requires a permitting process that initially requires the owner to have owned the property for 5 years and then go through a stringent permitting process.

This has essentially shut down short-term rentals in residential properties and now Maui only allows short-term rentals in designated condo communities, with only a few exceptions.

No New Construction + No New Permits= Limited Supply

Along with this, there has been an ongoing moratorium on the permitting for the construction of short-term rentable condo projects that was recently extended through 2024 and many see it getting extended further. If you’re familiar with the most recent developments on Maui, such as Wailea Hills La’i Loa or Makalii, you know they have all been zoned only for residential use as primary homes, second homes, or long-term rentals.

This is all in an effort by the county to limit the total number of accommodations available for visitors. The county has chosen a direction against overdevelopment on Maui and is acting aggressively in that direction. Visitor arrivals have meanwhile continued to increase and demand for accommodations is expected to continue its rise. Limited supply and growing demand are a windfall combination for investors.

AirDNA reports that markets with growing short-term rental supply, such as Nashville or San Diego, may experience more competition resulting in lower nightly rates and lower occupancy. This is the opposite of what’s happening on Maui.

Best Places to Own a Short-Term Rental on Maui

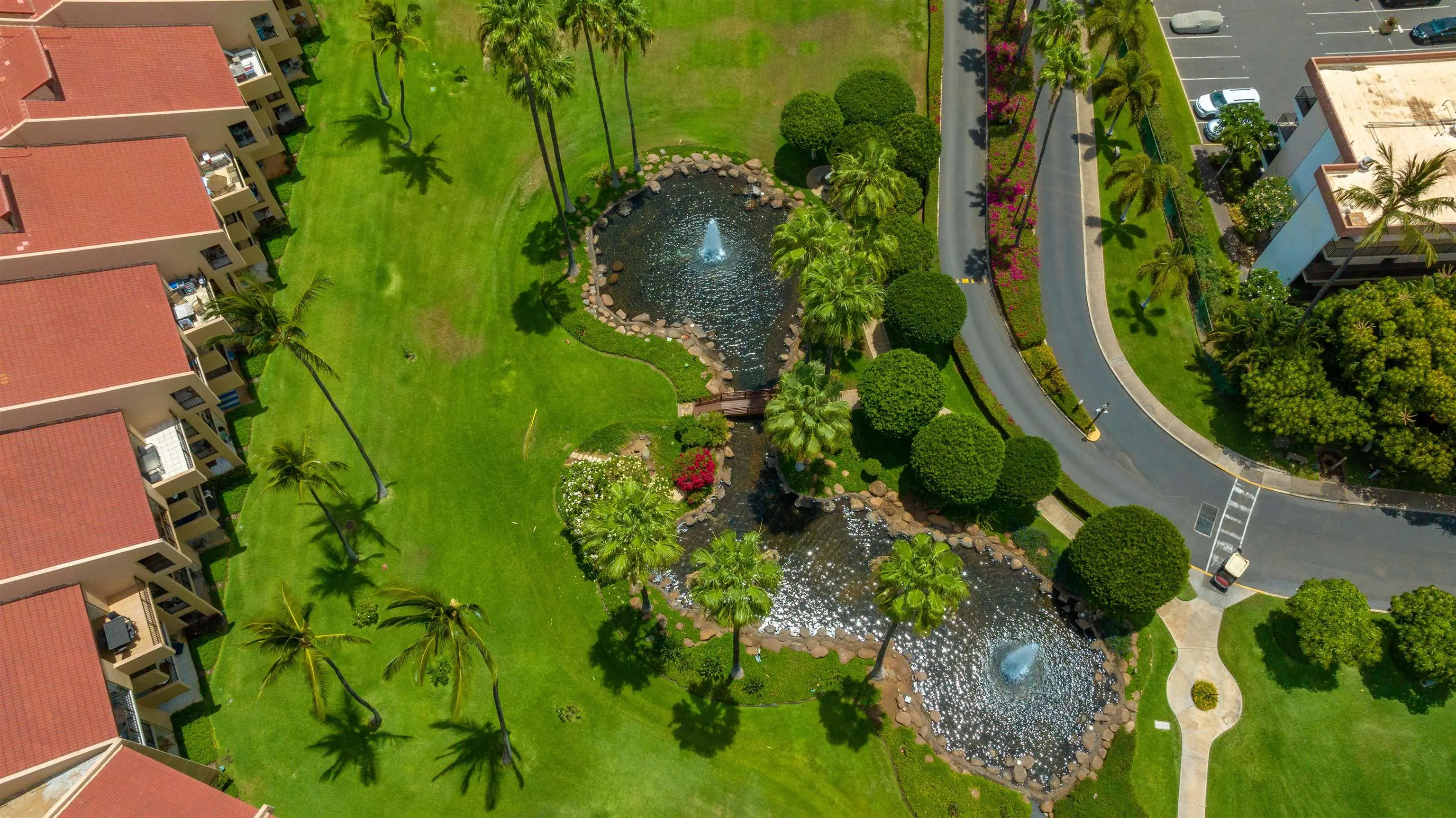

The short-term rental market is fairly narrow on Maui, there are really only two main areas that offer these types of opportunities. West Maui and South Maui. In West Maui we have 6 distinct areas for short term rentals; Lahaina, Ka’anapali, Honokowai, Kahana, Napili, and Kapalua.

Short Term Rentals West Maui

In South Maui, we have 4 distinct areas; Ma’aalea, North Kihei, South Kihei, and Wailea, and one short-term rentable complex in Makena, Makena Surf. Prices vary from area to area with Wailea, Kapalua, and Ka’anapali having the highest prices.

Short Term Rental South Maui

What To Look For in a Sound Investment on Maui

.jpg)

When buyers reach out to me about short-term rentable condos on Maui, my goal is to help them to secure a property that will perform well as a rental that also meets their own needs for usage. Most of our buyers in this market first start looking for a unit for themselves because they visit regularly and have decided they want their own place, but they also want it to essentially pay its own way.

Depending on which Maui lender you work with, you can get a down payment as low as 20%, although many lenders will require 30% down for these units. After the initial down payment, the goal is to have the maintenance fees, property taxes, principal and interest, utilities, and all other costs of ownership covered by the rental revenue. Often, we see units that can do all of this and more, netting the owner a profit each month.

Working With The Right Team of Professionals

In addition, getting connected with a property management company on Maui can take all of the work out of the equation. While some of my investor clients manage their own condos, the majority of vacation rental owners on Maui use a property management company. These companies charge around 25% of your gross revenue, but will take care of everything from marketing your unit, coordinating with guests, overseeing any required maintenance, and making sure your vacation rental is in 100% compliance with the county.

Finding the right combination of location, floor plan, price, and revenue is a balancing act that takes experience! Fortunately, I’ve had a lot of practice and have helped many clients find their dream investment condo on Maui. If you have any questions about purchasing or selling a property on Maui, please don’t hesitate to reach out!

Get In Touch With Evan!

_(1).jpg)

Evan Harlow ranks among the best real estate agents on Maui annually and is in the top 1% of Coldwell Banker agents worldwide in production. Evan has the expertise, experience, and work ethic to help you achieve your real estate buying and selling goals. We promise exceptional service and support from the beginning of the process through closing and beyond. See what Evan's clients are saying on Google.

Posted by Evan Harlow R(S) on

.jpg)

_(1).jpg)

Leave A Comment