Maui Real Estate Market Report October 2025: Maui County Council Waters Down STR Ban Bill While Values Fade and Listings Rise

.jpg)

Before diving into the Maui real estate market as a whole, I would like to share an important update on Bill 9 and the short-term rental ban. The Temporary Investigative Group(TIG) of the Maui Housing and Land Use Committee met on October 14th,2025, and released its findings/suggestions for amendments to Bill 9.

You can read the full memorandum and my analysis here. Essentially, and most importantly, the findings suggest that the ban not apply to a large number of complexes (plus grandfathered single-family properties) that meet specific criteria and be allowed to upzone to two new Hotel Zoning classes.

View all Hotel Zoned STR Listings.

The criteria that the TIG used were that the market values of the units would be unattainable to the average resident of Maui, that the property is in a sea-level-rise area (oceanfront complexes), and that the property has lawsuits that would interfere with a buyer needing financing.

The current list of complexes (subject to change) that are being proposed to continue allowing short-term rentals is:

Maui Condo Complexes Possibly Exempt from STR Ban

.jpg)

Possible Short-Term Impacts on the Maui Market

This will undoubtedly impact the condo market even while it is still being decided. While we have months to go before the final version of the bill is presented and passed, sellers in these complexes have reason to believe they will be allowed to continue business as usual and these sellers may be less likely to keep lowering prices. This would provide much-needed stability to the condo market that has seen monthly value declines since the proposal was made in May of 2024.

This could also give us reason to believe that the bill itself, overall, could fail.

However, it doesn’t feel like this is enough to see the loss in value —up to 30% or more in some cases —immediately return, until we have more information on whether the Council decides to include the recommendations in the final version of the bill. Given that four of the council’s nine members were in this temporary investigative group, and those members had voted both for and against the bill on the initial vote, it seems the recommendations will become an amendment to the bill and see inclusion in the final version.

I see this as a very positive development, yet still not the complete outcome most of us are hoping to see. This shows the council's willingness and ability to balance the bill's goal of improving access to affordable housing on Maui with the real-world economic consequences of gutting the island’s primary economic driver, tourism, and the real property tax revenue these units generate, which benefits all residents.

Will the Bill Even Get Passed If It Has Amendments Like This?

In the final analysis of this entire process that we will have a year or two from now, I still believe all of this will be a moot point when the bill loses the legal challenges it will face, even if passed in a more limited form, unless it provides adequate financial compensation to those who will have their vested property rights taken away through the passing of this bill.

Newest Maui Properties For Sale

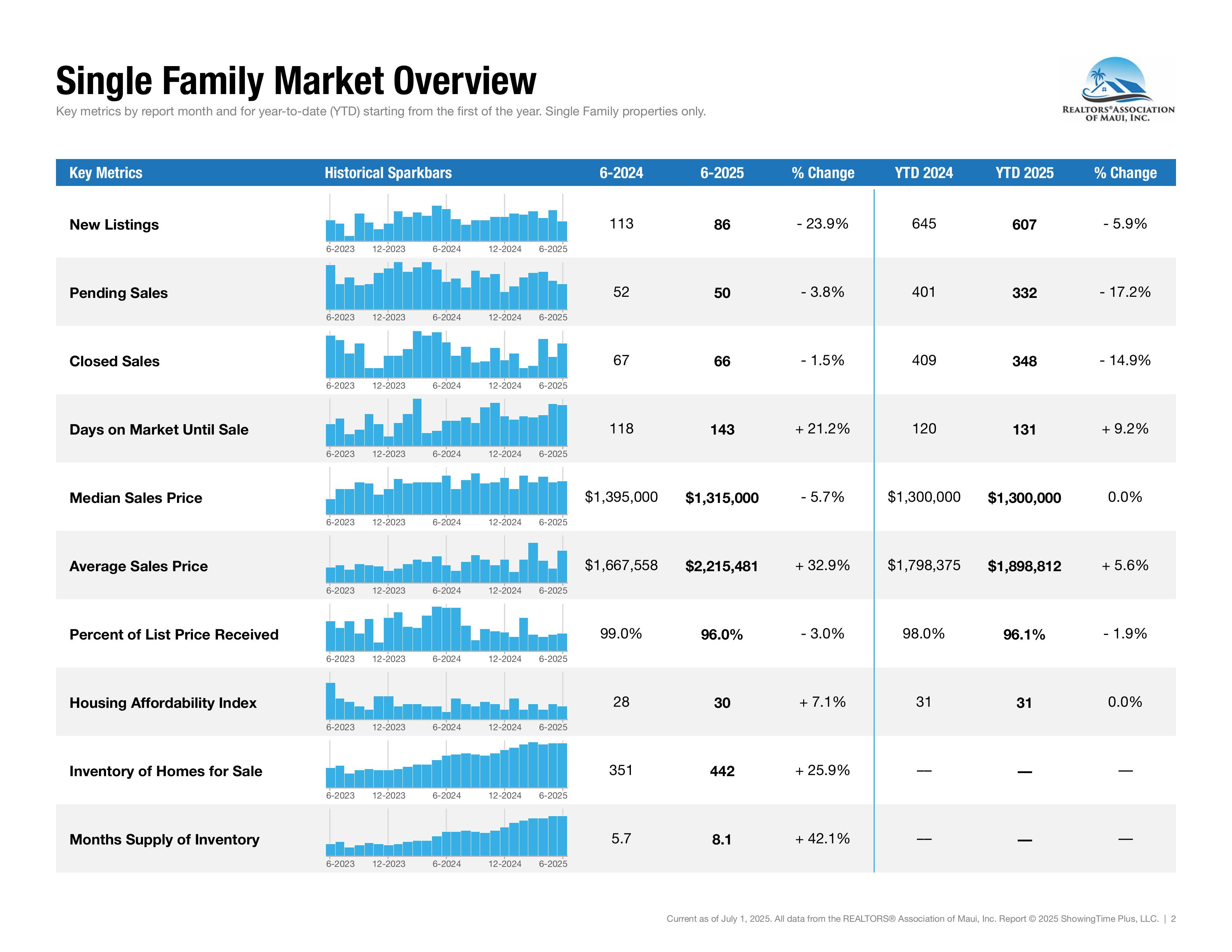

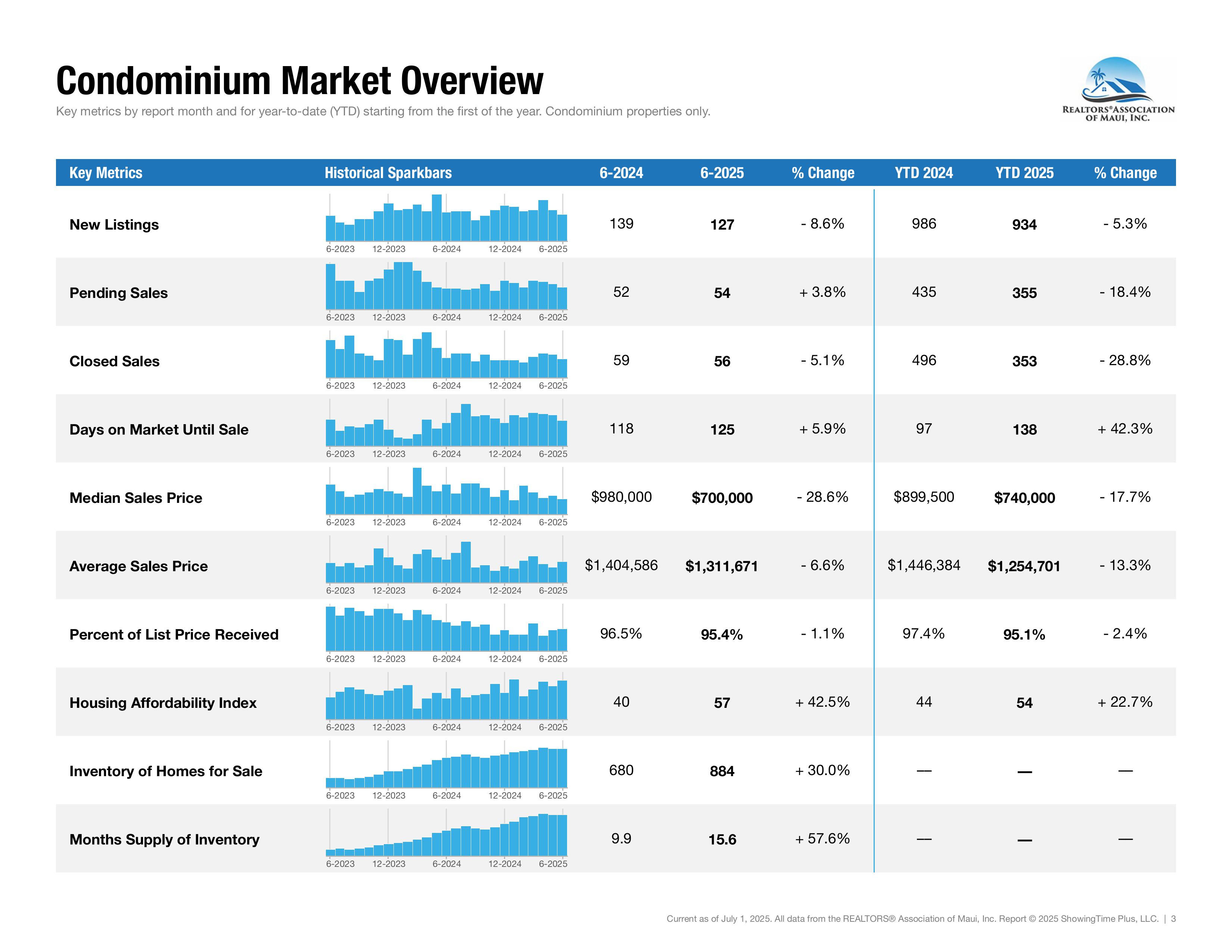

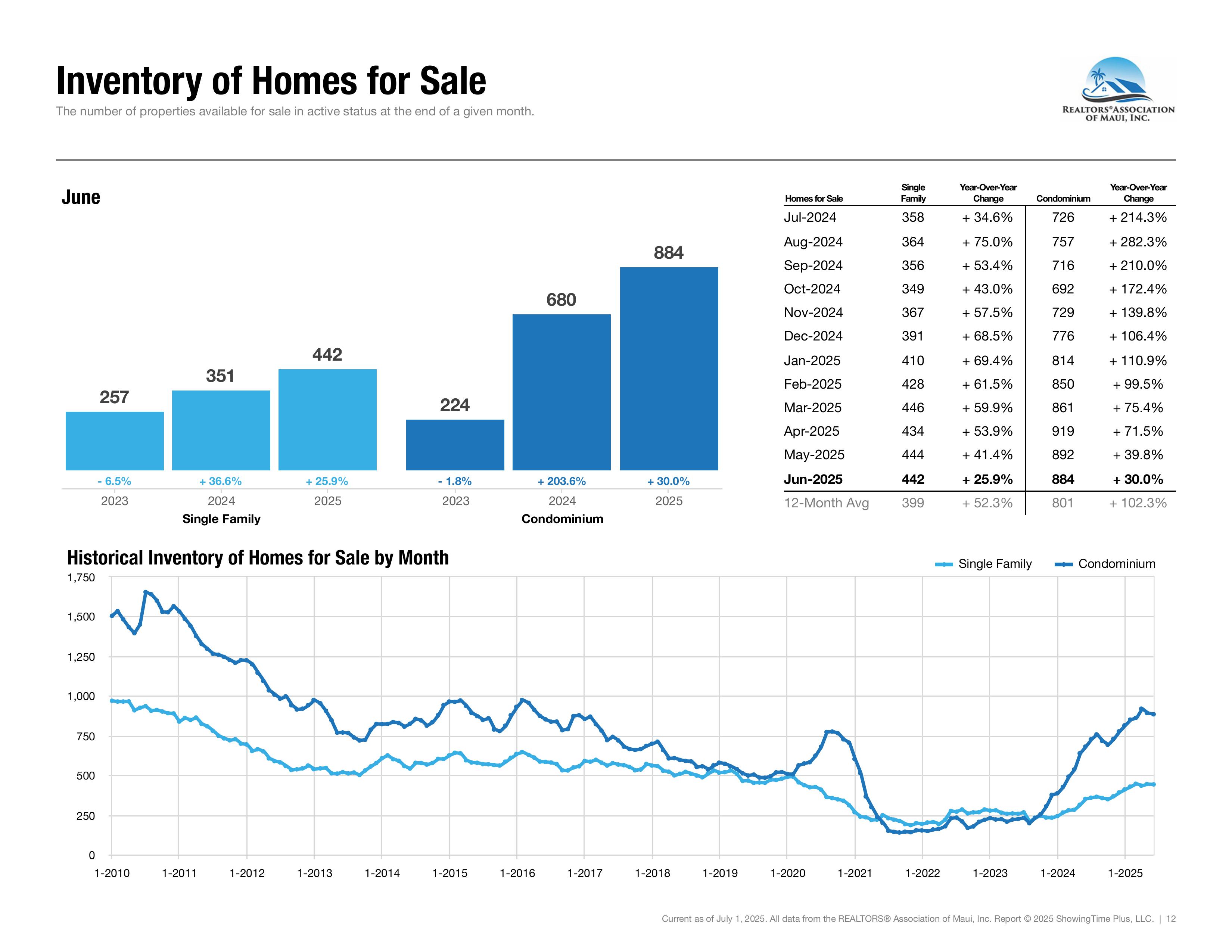

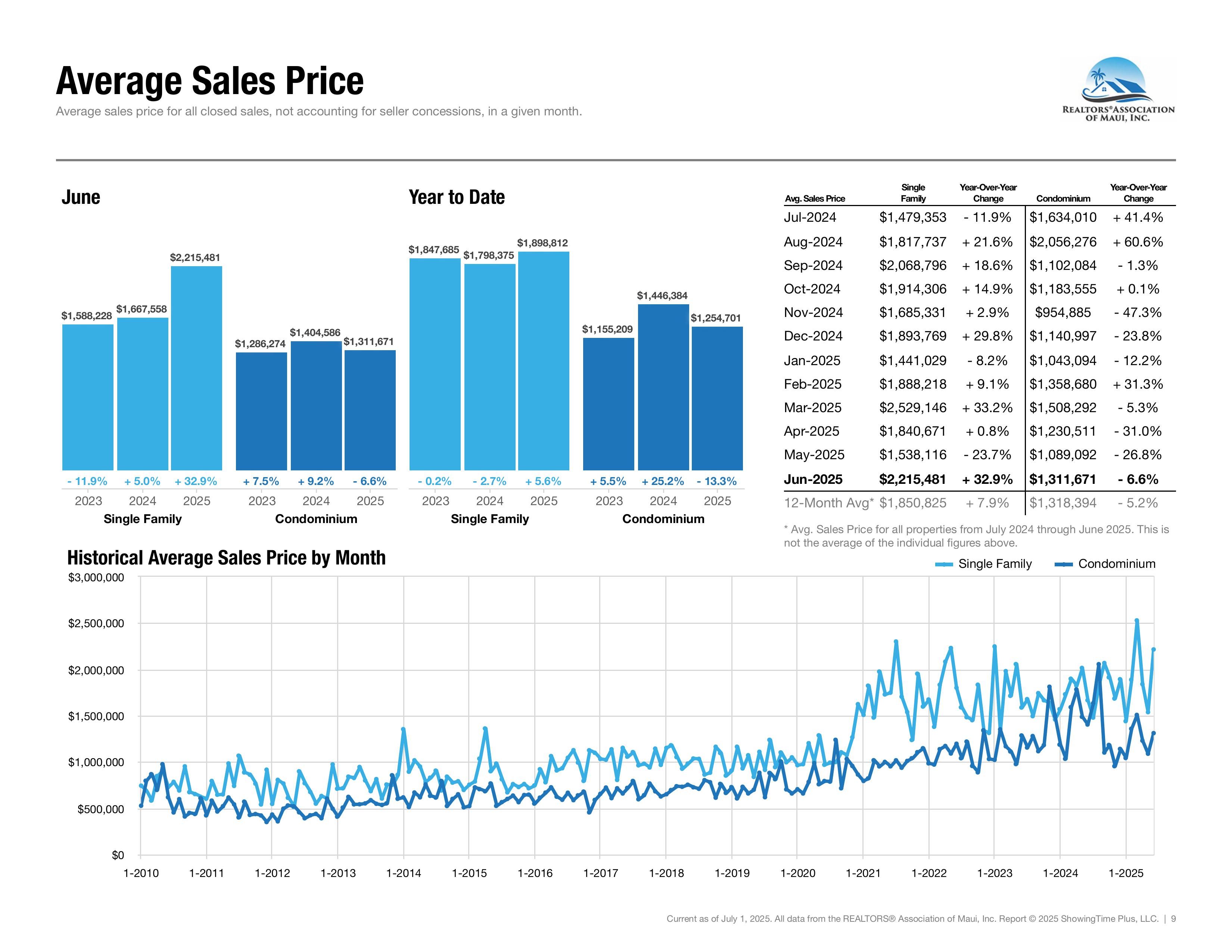

Maui Real Estate Market: Values Trend Lower with Signs of Stabilization

Circling back to the Maui Real Estate market. The market continues to be a buyer’s market, even more so in the condo market, but also now more in the single-family market. The single-family market had been holding values and seeing higher absorption rates than the condo market for the last year. Now, the months supply of inventory of single-family homes has jumped to 8 months, up 38% from the same period last year, when Maui had 5.9 months of single-family inventory.

Typically, with this metric, we see 6 months supply as a neutral market, anything below 6 months is a seller's market, and anything above is a buyer's market. The condo market now has a 15-month supply of inventory. Up 38% from the previous period last year as well.

How Much is Real Estate on Maui?

Maui Real Estate Market Single Family Home Data September 2025 vs. September 2024

-

Pending Sales Down 6.3%

-

Closed Sales Up 7.7%

-

Days on Market Up 10.4% to 127 days

-

Median Sales Price Down 9.5% to $1,292,500

-

Average Sales Price Down 14.8% to $1,763,585

-

Inventory of Homes for Sale Up 23.7% to 439 active listings

-

Months Supply of Inventory Up 38.6% to 7.9 months

Maui Real Estate Market Condo Data September 2025 vs. September 2024

-

Pending Sales Up 7.7%

-

Closed Sales Down 11.8%

-

Median Sales Price Down 33.8% to $655,000

-

Average Sales Price Down 12.4% to $965,351

-

Inventory of Condos for Sale Up 19% to 852

-

Months Supply of Inventory Up 38.3% to 14.8 months

Great For Buyers, Not As Great For Sellers

The good news for buyers is the not-so-good news for sellers. Prices are down. Affordability is up. I was recently having lunch with a client of mine who has been involved in global financial markets throughout his professional career.

He was reminding me that all markets are cyclical, and this is a much-needed break for long-term, sustainable price appreciation in the Maui market. This provides some opportunity for buyers who were getting priced out and a chance for a rebalancing of revenues with prices on STR units.

.jpg)

Real estate cycles take time to play out, and we are trending towards the bottom of this market cycle. Especially if the Federal Reserve accelerates its rate-cut cycle in Q4 2025 and in Q1 and Q2 of 2026, given the weak national labor market growth. Please feel free to reach out to me anytime with your questions about the Maui market at 808-214-4799.

Get In Touch With Evan!

_(1).jpg)

Evan Harlow ranks among the best real estate agents on Maui annually and is in the top 1% of Coldwell Banker agents worldwide in production. Evan has the expertise, experience, and work ethic to help you achieve your real estate buying and selling goals. We promise exceptional service and support from the beginning of the process through closing and beyond. See what Evan's clients are saying on Google.

Is It a Good Time to Buy Property in Maui?

This is the most loaded question I get asked. As a real estate agent, the answer people always expect us to say is simply and emphatically, yes. Maui real estate has always outperformed. However, even in hot market or a slower market, there are a lot of nuances to a correct answer. Generally speaking, looking at the market, its a better time to be a buyer than it has been in years from several perspectives. Every area of Maui is its own market, learn more about the Wailea Real Estate Market.

We are in a buyer's market. This doesn't mean that in certain niche complexes and neighborhoods that buyers can negotiate prices lower, but overall we have a very high level of condo inventory, specifically in the apartment zoned STR category. Maui also has more single-family home inventory than we have had in years. So, from an option perspective, its a great time to be a buyer.

We're now floating in the low 6% range on mortgage rates with a lower average than we have seen in the last two years. With the most recent jobs report, its unlikely we will see that second rate cut in 2024, but most experts agree we are still going to be floating down for the next few years and lenders are offering free refinancing as rates go lower. From a rate perspective, yes its a better time to be a buyer.

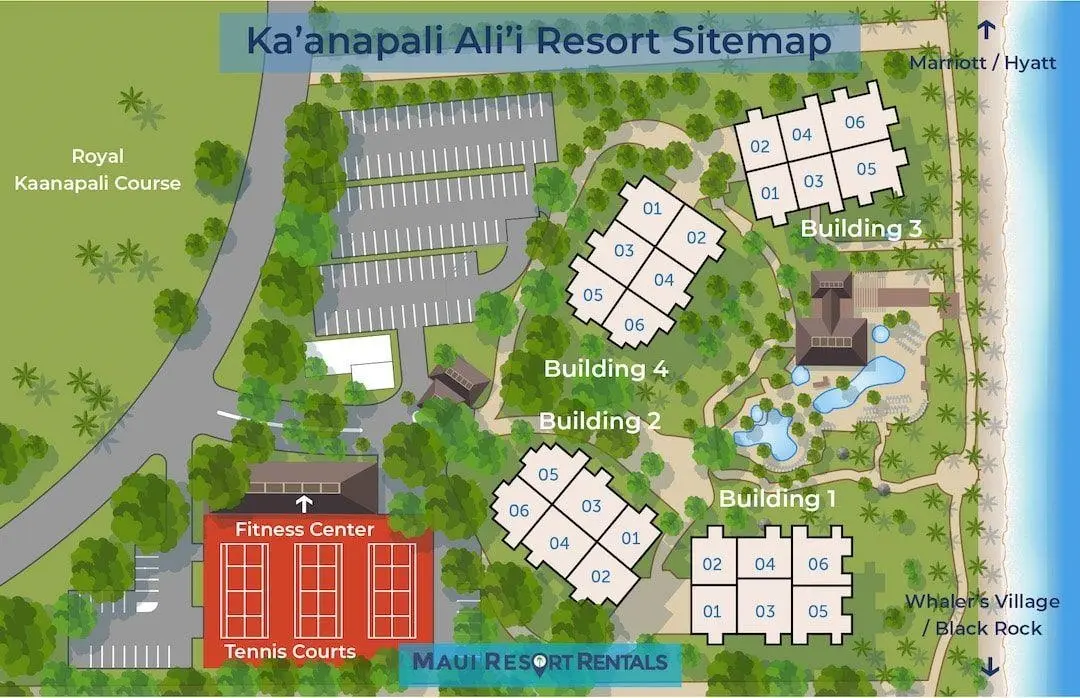

For buyers willing to assume some risk, there are some great opportunities to be had in the STR market. All we can do is use the available information to calculate the risk and make informed decisions. In July, the Planning Commission indicated that it would recommend that the County Council allow apartment-zoned STRs in resort districts, including Wailea, Kapalua, and Ka'anapali, to rezone to hotel.

Assuming the ban passes all of its obstacles to becoming law, it is now less likely to include those areas, and that makes sense as these are the absolute worst options for affordable housing as they have the highest HOA's and carrying costs. We have been seeing more activity in those zones after the Planning Commission meeting.

Browse Condos For Sale Around Maui

Maui Real Estate Market Report July 2025: Still Waiting on County STR Vote Amidst a Buyer's Market

Through the first six months of 2025, the Maui real estate market has remained relatively static and continues to be a strong buyers' market. While summer has historically been a time of increasing activity, most buyers are still waiting to see what happens with the STR ban. As of now, the County passed the initial version of the bill, however, three more sessions will be required to pass the final version of the bill which is expected to have amendments that will exclude the resorts areas of Wailea, Kaanapali, and Kapalua and/or apartment zoned oceanfront condo complexes such as Maui Sunset or Hale Ono Loa.

The uncertainty created by Maui County dragging its feet on the STR ban vote, along with surrounding broader macroeconomic factors, higher interest rates, and higher costs of ownership, continues to suppress the levels of buyer demand that Maui has been used to over the last 15 years.

Because of the Mayor’s disastrous STR ban proposal, we also find ourselves with burgeoning inventory and lower values in the condo market, making it a great time to be a buyer on Maui and not as great of a time to be a seller. In fact, as I will point out in the data below, sales volume is down in a meaningful way, and we have seen a decline in average prices in the condo market, primarily due to the significant discounts on apartment-zoned short-term rental condos over the previous 12 months.

The single-family home market has fared much better than the condo market and has had a steady 5%+ YoY appreciation.

Get a FREE Comparative Market Analysis in today's market. Read My Complete Guide to Selling Your Home or Condo on MauiWhat's your home worth?

How is the Condo Market on Maui?

This is a multi-faceted issue, and there are many layers of pressure on condo values at the moment. Rising ownership costs are one of the biggest concerns. This is mainly related to the increases in HOA costs resulting from substantial increases in insurance premiums over the last year. We’re now in an extended period of higher interest rates, which was preceded by one of the most significant periods of value appreciation. Higher prices, higher ownership costs, and higher interest rates are among the biggest factors.

The other significant factor that we have all talked about until we can’t talk about it anymore is, of course, the STR ban proposal that turned the condo market upside down a year ago. I’m writing this a few weeks before the Maui Housing and Land Use Committee is set to make a final decision on the proposal.

There has been discussion that they may amend the bill to meet more of the nuances of the issue, and we also know that last summer the Maui Planning Commission recommended allowing apartment-zoned condos in the resort areas of Wailea, Kapalua, and Ka’anapali to be upzoned to hotel zoning.

I will also update this article once new information becomes available from the meeting. You can read my thoughts on the whole thing in my Maui Short Term Rental Ban article.

Several other amendments have recently been proposed by Committee Chair Tasha Kama that seek to establish a longer horizon for the beginning of any phase-out, extending it to 2030, exempt existing timeshare units in complexes like Maui Hill in South Kihei, and require the Department of Finance to provide notice to the owners.

Browse Condos For Sale Around Maui

Sellers Seeing Longer Days on Market and Below Asking Offers

Is it a good time to be a buyer on Maui? Aside from higher interest rates (which appear primed to ease soon), there hasn't been a better time to be a buyer on Maui in a long time. While closed sales and pending sales remain at very low levels compared to the last 15 years, buyers in the market now are capitalizing on the opportunity, and there are deals to be found. Around three-quarters of closed sales were sold below the seller's list price last month..

Leaving listing prices higher without adjustments, some sellers haven’t come to terms with the fact that the seller's market is over. Other sellers are waiting to see what happens with the ban proposal before taking any action, as are many buyers.

It feels like many buyers are waiting on the sidelines to know which way the wind is going to blow on the issue of the ban, and many sellers are likely to cancel their listing and continue operating if the ban doesn’t pass. I personally don't think it can withstand the legal test if the Council does vote for it.

A similar ban was voted for on Oahu in 2022; it was immediately face with an injunction, and then deemed illegal in Federal court. If the Council does vote in favor of it, it will be a very narrow majority, as there are at least three council members(they know who they are) who are going to vote for the ban no matter what they hear or how detrimental it would be for the economy.

One thing is for sure: the Mayor’s idea that lower condo values will somehow magically make them affordable to local residents isn’t working because prices are down, and they aren’t being bought en masse by residents. This is because the majority, not all, of these apartment-zoned STR complexes were never intended for residential living by a family and only work functionally as vacation rentals. They also offer vacation amenities that the average median-priced buyer resident on Maui would not pay the HOA fees to have.

Ultra Luxury Buyers on Maui Remain Unbothered

_(1).jpg)

While sales in the median price range are very soft, Maui is seeing its ultra-luxury buyers continue to trade. Activity in the 5 million and up market of ultra luxury properties has remained consistent, as these are the clients who are able to navigate any type of market with ease.

These are buyers who don’t seek or need financing for their purchases and are usually moving money from one property to another. I recently had the privilege to represent the buyers of Wailea Point 101 in one of the highest-dollar transactions of the year so far, and I am currently representing a buyer of another ultra-luxury property in Mahaha Estates.

Wailea Point has had 5 sales year to date, when it only had 3 in 2024 and 2 in 2023.

Just last week, a property on Keawakapu Beach at 3200 S. Kihei Rd closed at auction for 25.5M, and the sale of the three units that comprise Building 6 at Sugar Cove in Paia closed for 11.5 M. 5415 Makena Rd in Makena also closed earlier in the year for 17.2M.

Ultra Luxury Maui Properties For Sale

I Love Questions About The Maui Real Estate Market

If you have any questions about the Maui real estate market, buying or selling, or are just curious, I'm happy to help any way I can. Feel free to call me at 808-214-4799 or send a message through the form below.

Get In Touch With Evan!

_(1).jpg)

Evan Harlow ranks among the best real estate agents on Maui annually and is in the top 1% of Coldwell Banker agents worldwide in production. Evan has the expertise, experience, and work ethic to help you achieve your real estate buying and selling goals. We promise exceptional service and support from the beginning of the process through closing and beyond. See what Evan's clients are saying on Google.

Buyer Representation Agreements Now in Practice

As a result of the recent NAR settlement, buyers and buyer agents are now required to have a buyer representation agreement signed before touring a property.

The agreement document itself isn't new, just the requirement to have it signed prior to showing property. It hasn't had a negative impact on the process and actually provides an extra layer of security for both buyers and real estate professionals. To learn more about how I'm using the agreement and working with my clients, read my full article on working with a buyer's agent here.

Is It a Good Time to Sell on Maui?

This one is a little tricky. It is still not a great time to be a seller of an apartment zoned STR unless you have owned for more than 5 years and really need to sell. I have consulted many owners over the last few months and have even encourage many not sell until the dust has settled on the whole ban proposal in early 2025

The apartment zoned STR market is flooded and even with reduced prices, they are not moving because of the fear the mayor has stoked. I encourage each and every owner and person who cares about Maui to fight the proposal through all means including writing the Maui County Council.

For single family homes, hotel-zoned condos, and the rest of the market, its a great time to get ready to sell if you're considering. By that, I mean we are coming into the winter months that have historically been our best season for sales. The market is already showing signs of improvement and tourism pre-bookings look much better for this winter which will stimulate more buying.

To fully capture that market, listing in lateDecember/early January will give you the best period of time for activity. By planning now, we would be able to address any work the home may need and develop a comprehensive marketing strategy to capture its highest and best price. Learn more about my selling process here.

Browse New Listings on Maui

Interested in Learning More About Maui Real Estate?

Please feel free to call or email me with any questions you may have about thee current market on Maui. Maui's real estate market is diverse and nuanced, as such, general market principles don't always apply to every property. I'm happy to listen to your buying or selling goals and provide my opinion anytime. Have a great holiday season!

Get In Touch With Evan!

_(1).jpg)

Evan Harlow ranks among the best real estate agents on Maui annually and is in the top 1% of Coldwell Banker agents worldwide in production. Evan has the expertise, experience, and work ethic to help you achieve your real estate buying and selling goals. We promise exceptional service and support from the beginning of the process through closing and beyond. See what Evan's clients are saying on Google.

Previous Maui Market Report - August 2024: Bad Politics and High Interest Rates Make A Cold Summer For the Maui Real Estate Market

.jpg)

Since the announcement of the proposed short term rental condo ban in the apartment districts on Maui on May 2nd, the Maui real estate market has been reeling from the potential impact the ban would have on values. In the last three months, a veritable tidal wave of condo inventory has hit the market in the apartment zoned short term rentable complexes amid the uncertainty of the possibility of the ban happening.

You can read more about the current status and legal challenges of the proposed ban here, but for the purposes of this market report, I’ll stick to the ramifications its having on the current market that for the first time in a long time favors buyers.

A Buyer's Market in Full Swing

In my last market report back in May, the market was shifting from a neutral market to a buyer's market and now we are definitely in a buyer's market. The condo market isn’t the only market that has slowed down considerably, the single family market is also showing the effects of the current interest rate cycle.

While mortgage rates have dropped in the last week to their lowest level in over a year and appear to be headed lower, single family homes have been taking longer to sell and buyers have been able to negotiate discounts from listing prices more often than not.

The only buyers in the short term rental condo market in the apartment districts are those who are hunting for a deal and many are finding them. Many sellers are concerned about the long term impacts the ban will have on their ability to carry their units over time and are having to drop prices dramatically to secure a contract or face sitting on the market indefinitely.

Other long term rental condo complexes are also facing challenges finding buyers as the HOA costs have increased significantly due to rising insurance costs and being required to carry 100% rebuild cost on their policies. It's important to work with an expert buyer's agent on Maui when buying a home or condo due to the evolving costs and nuances of thee market.

If you have read my previous market reports or are very familiar with the Maui market you'll know that Maui has many micro markets and even though we are a small island, every area of the island is its own market in many ways.

Looking Upcountry or in Haiku, you wouldn't notice too many changes, its still relatively low in inventory and home sales are pretty normal. Prices are on a gentle upwards trajectory. If you're looking for a single family home in Wailuku or Kahului it can still be challenging and is still more of a seller's market with several homes going over asking in certain circumstances.

Browse Condos For Sale Around Maui

However, a majority of our transactions take place in South Maui and West Maui where the larger supply of second homes and investment condos are. The second home market is still moving fairly consistently, but there is a little more inventory than we have been used and buyers are being much more selective. In the fire affected areas of West Maui there is still some hesitation for many second home buyers until the future of Lahaina becomes more clear.

Hotel zoned short term rental condos around Maui are still in a neutral level of inventory with stable pricing, but the demand has softened somewhat and that has created opportunities for some buyers to find discounts in that market. In contrast, the apartment zoned short term rentals are abundant on the market and only selling for 25-40% below their pre-STR ban proposal prices.

.93.jpg)

_(1).jpg)

Leave A Comment